Ignacio García-Legaz (MasOrange): “The challenge of AI is that it is easy to use, massive and that it provides value to the customer”

El director del área de Televisión del grupo MasOrange, Ignacio García-Legaz, analiza el mercado de los servicios televisivos de las telcos, en el que la propuesta de Orange TV ha irrumpido con una transformación de la marca con el foco puesto en la tecnología y su papel como superagregador.

En abril del pasado año, MasOrange se presentó en sociedad como la compañía “líder” del sector de las telecomunicaciones en España por “número de clientes”. Esta fusión de Orange España and the Grupo MásMóvil, abarcando también marcas como Yoigo o Euskaltel, trajo consigo la promesa de inversiones de 4.000 millones de euros para consolidar su rol en el mercado, impactando directamente en terrenos como la expansión de su infraestructura, la creación de nuevos servicios o la innovación en ámbitos como los datos o la inteligencia artificial.

En aquella presentación apenas se trató en detalle el negocio televisivo del grupo, el cual ha atravesado una gran transformación representada por su marca premium: Orange TV. Y es que el equipo dirigido por Ignacio García-Legaz ha trabajado en profundidad en la redefinition of the service para situarlo en la primera línea de las ofertas televisivas españolas.

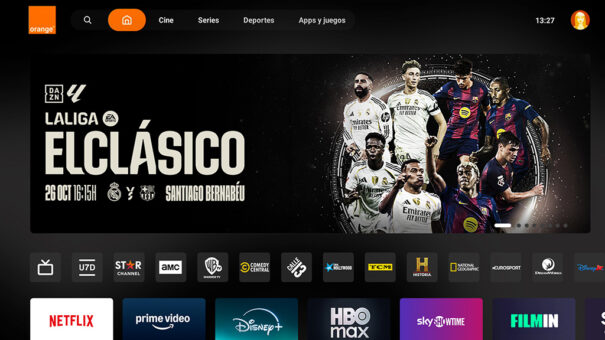

Para ello, se ha facilitado la interacción del usuario con la UI del servicio, se ha realizado una profunda inversión en el posicionamiento de la marca entre el público futbolero con el comienzo de la temporada de LaLiga y se ha hecho un gran hincapié en novedades tecnológicas dirigidas a mejorar la experiencia de los usuarios. Entre estas mejoras, destaca la tecnología True Motion, que duplica los habituales 25 fps en las retransmisiones de fútbol; un sistema de latency reduction, que permite que las imágenes se emitan hasta 2 segundos antes de la TDT, e incluso se ha lanzado el servicio Infinity HomeBox, un paquete con un decodificador premium 4K compatible con HDR10+ y Dolby Vision, y que incluye audio certificado por la marca de consumo Bang & Olufsen y capacidades inmersivas de Dolby Atmos.

En esta entrevista, realizada en los prolegómenos de la compra de Orange del 50% que no controlaba de MasOrange, García-Legaz analiza la evolución del mercado televisivo de las telco y de las propuestas de su marca, abordando áreas tan clave como su rol como superagregador, the dependencia del contenido futbolístico o cómo las mejoras tecnológicas solo tienen sentido si van orientadas a mejorar la experiencia de los usuarios.

El mercado de televisión telco en 2025

¿De dónde venimos y hacia dónde se está dirigiendo el mercado de las ofertas televisivas de las telco?

El rol de la vertiente televisiva de las telco sigue siendo ofrecer una oferta convergente en la que el cliente esté satisfecho a nivel global, obtenga un beneficio económico y le resulte todo más fácil: desde la contratación, hasta el soporte, pasando por la experiencia. Aunque se haya evolucionado de un modelo de satélite o cable, las telco han seguido adaptándose tanto en la parte técnica como en la oferta de contenidos y propuesta comercial al mercado.

Aunque parezca que las cosas han cambiado, no lo han hecho tanto: el operador llega a acuerdos mayoristas o de volumen con proveedores de contenidos, empaqueta una oferta ajustada a sus clientes, le pone un precio, la combina con servicios telco y la comercializa. La principal diferencia es la aparición de nuevos agentes: las famosas OTT, que, además de comercializarse a través de los operadores, lo hacen con ofertas directas al consumidor. Pero, si lo miramos con perspectiva, seguimos llegando a acuerdos con los mismos proveedores de contenido: Disney, Warner…

En paralelo, el rol de los contenidos ha ido a más. La penetración histórica de la televisión de pago era muy baja en España comparada con otros mercados, como el británico, el portugués o el norte de Europa. La llegada de las OTT ha ayudado a que determinadas marcas tengan mayor notoriedad y conocimiento por parte de los consumidores, lo que ha favorecido que los operadores telco, que empaquetamos estos servicios junto con muchos otros, podamos aumentar la penetración de la televisión de pago.

A pesar de que se han multiplicado las ventanas, la televisión de pago está superando récords de espectadores. ¿Qué elementos hace que se erija frente a otras alternativas lineales o incluso algunos canales de la TDT en abierto?

Durante estos últimos 25 años, se ha producido una fragmentación del consumo en muchos ámbitos. Ha habido un aumento de la oferta, tanto en canales, como en contenidos: la oferta multicanal en el pago es amplísima, han aparecido más canales en la TDT, han surgido players de streaming en diferentes categorías y el deporte también ha encontrado su hueco en esta ventana. Además, el consumidor ya no utiliza un solo dispositivo para acceder a los contenidos.

“La llegada de las OTT ha ayudado a que determinadas marcas tengan mayor notoriedad y conocimiento por parte de los consumidores”.

Esta fragmentación de alternativas para acceder a los contenidos ha hecho que agentes como los operadores de televisión de pago hayan dado un paso al frente para juntar todos estos elementos de forma sencilla. De esta forma, se ha favorecido que el consumo se dirija hacia esta categoría.

MasOrange, frente al negocio de la TV

Un año después de su nacimiento, ¿cómo ha consolidado MasOrange el lanzamiento de su renovado negocio televisivo?

Hace más de dos años decidimos enfocar la televisión en nuestras diferentes marcas. Y es que desde MasOrange disponemos de una ventaja clave. El hecho de disponer de diferentes plataformas conlleva una mayor complexity, pero también permite diseñar ofertas más definidas o segmentadas para cada segmento de cliente. Por ello, el primer ejercicio que hicimos fue la construcción de un diseño multimarca de la televisión, decidiendo qué atributos y qué propuesta de valor otorgábamos para cada una de estas marcas.

“El hecho de disponer de diferentes plataformas conlleva una mayor complexity, pero también permite diseñar ofertas más definidas o segmentadas para cada segmento de cliente”.

Esta propuesta de valor tiene muchos ejes, partiendo del contexto telco. Pero, si nos centramos en el aspecto de la televisión, abarca qué dispositivo ofrecemos al cliente (decodificador, decodificador premium…), qué tipo de content (más o menos canales lineales), qué streaming services integramos, qué sports content incluimos y qué peso puede tener esa propuesta en la visibilidad de la marca. Porque podemos disponer de televisión en una marca de bajo valor sin hacer mucha comunicación, pero empujar otras marcas. Este diseño tiene muchos ángulos.

En esa oferta televisiva, Orange TV sigue siendo vuestra marca premium. ¿De qué forma se ha transformado su propuesta?

Hemos puesto mucho esfuerzo en evolucionar Orange TV para tomar todos los elementos que componen una oferta televisiva y elevarlos con la máxima ambición. Esto se manifiesta desde los decodificadores disponibles: el usuario que tenga en su casa una SmartTV pegada en su pared y no quiera dispositivos podrá acceder a través de la aplicación, pero es que también ofrecemos opciones 4K y un modelo premium con sonido integrado de Bang & Olufsen, al que además se le puede sumar altavoces adicionales.

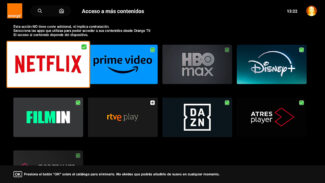

“Si miramos hace cuatro años, apenas teníamos acuerdos con muchas OTT ni demasiado contenido deportivo. Ahora, contamos con Amazon Prime, Netflix, Disney, SkyShowtime, HBO Max, Filmin, Atresplayer…”

En la parte de experiencia, un elemento muy relevante y del que estamos viendo resultados muy positivos, hemos hecho un gran esfuerzo para que la navegación por la interfaz de usuario sea muy buena. Contamos con motores de recomendación, elementos de vídeo en toda la UI, diferentes opciones para que se adapte a cada uno de los perfiles de dentro del hogar y un modelo de inicio de sesión simplificado y alineado con las mismas credenciales de su móvil. En esta interfaz, además, están directamente integrados los 200.000 títulos de todas las OTT.

Luego, hemos trabajado en profundidad en la calidad del vídeo y del audio. Por ejemplo, en el apartado deportivo, hemos reducido la latencia e implementado la tecnología True Motion para contenido deportivo. En el audio, traemos un elemento diferencial: incluimos opciones de Dolby Atmos para nuestro contenido así como para el de terceros.

¿Este impulso renovador también se extiende a la selección de contenidos de Orange TV?

Si miramos hace cuatro años, apenas teníamos acuerdos con muchas OTT ni demasiado contenido deportivo. Ahora, tenemos a todos los que hemos considerado relevantes: Amazon Prime, Netflix, Disney, SkyShowtime, HBO Max, Filmin, Atresplayer…

En la parte de los deportes también hemos dado pasos importantes. Más allá de LaLiga y la Champions League, que la seguimos ofreciendo, hemos incorporado campeonatos como MotoGP, Fórmula 1 o la NFL a través de DAZN.

Nos encontramos en un nivel de propuesta realmente muy buena en su ámbito global. Dentro de ofertas convergentes, diría que ofrecemos la mejor relación precio-valor del mercado.

La importancia del fútbol para las telco

El fútbol sigue siendo uno de los pilares de la propuesta no solo de Orange TV, sino de los grandes operadores televisivos de España. ¿Existe una excesiva dependencia de este tipo de contenidos?

El fútbol, como categoría deportiva de mayor valor, sigue siendo relevante para un segmento importante de los clientes de televisión de pago, el cual históricamente ha estado en torno al 30%. Es un contenido con unos costes de derechos muy significativos, pero sigue siendo clave. Lo que hay que intentar es ser conscientes de lo que cuestan estos derechos en origen.

Muchas veces existe el debate de si las telco nos hacemos ricos con estos derechos, y la respuesta es que no son los de mayor margen: ni muchísimo menos. No creo que sean imprescindibles, pero sí considero que es muy conveniente tenerlos para competir en determinados segmentos. Esa es la razón por la que Orange TV, a pesar de los costes, sigue apostando por mantenerlos.

En otros mercados europeos, vemos cómo agentes OTT como Netflix o Amazon Prime Video comienzan a pujar, y con éxito, por las grandes competiciones futbolísticas. ¿Estos movimientos podrían desestabilizar el mercado de la televisión de pago?

El objetivo de los propietarios de los derechos en las subastas es maximizar el valor de su propuesta. Por tanto, si fragmentando su oferta o creando paquetes alternativos pueden hacer que el total sea más alto, lo harán. Es entendible. Otra reflexión diferente es si, a costa de eso, estás perjudicando al consumidor, which también creo que es el caso. Los propietarios de derechos intentarán ver si hay un upside suficientemente relevante a pesar de esta fragmentación; si lo hay, lo harán. Si es pequeño, premiarán mantener la competición en un menor número de agentes.

“Muchas veces existe el debate de si las telco nos hacemos ricos con estos derechos, y la respuesta es que no son los de mayor margen: ni muchísimo menos”.

Dicho esto, para Orange no es un problema muy grave, ya que esta situación está pasando hoy en día. En el caso de LaLiga, compramos la competición a dos agentes: Telefónica y DAZN. Este fenómeno se repite con el baloncesto. La NBA cuenta con partidos en Prime Video y DAZN.

En definitiva, estamos ante una dinámica de la cual haría una lectura positiva. Dentro de esa complejidad, tiene sentido que los operadores de televisión de pago agreguemos todos estos servicios y los simplifiquemos dentro de una experiencia única, para que el espectador pueda ver los encuentros independientemente de por dónde se ofrezcan. Es lo que estamos haciendo con el fútbol y lo que pretendemos seguir implementando en el futuro.

Tecnología y experiencia: valores clave

En un contexto en el que los operadores telco de primera fila redefinen su propuesta como superagregadores, ¿el valor añadido, tanto en experiencia de usuario como tecnología, será el verdadero elemento diferenciador entre los agentes de la industria?

A la hora de diferenciarnos, hay que intentar pensar qué valor podemos aportar al cliente. En este terreno, hay elementos muy importantes como la experiencia de agregación, la interfaz de usuario o el propio proceso de on boarding. Es decir: tenemos que hacer fácil que el espectador pueda acceder por primera vez al servicio y luego pueda seguir utilizándolo. Este proceso pasa por mejorar la calidad de la experiencia, pero también por trabajar el descubrimiento de los contenidos o el tipo de recomendaciones, sean editoriales o basadas en su propia interacción con la plataforma.

“Como no tenemos contenido propio, no tenemos ninguna obligación de empujar nada. Si destacamos un contenido, es porque creemos que es bueno”.

En Orange TV, contamos con una parte muy determinante de la experiencia del usuario que es totalmente automática. Y tenemos una ventaja: como no tenemos contenido propio, no tenemos ninguna obligación de empujar nada. Si destacamos un contenido, es porque creemos que es bueno. Esa neutralidad, junto con el uso avanzado de una tecnología orientada a hacer la vida del cliente más sencilla, cada vez será más relevante.

Además, en un contexto de una mayor diversidad de segmentos de edad, usuarios, dispositivos, operadores y OTT, la simplicidad va a pasar a ser un elemento clave.

Al describir su propuesta tecnológica, Orange TV destaca su tecnología True Motion o sus herramientas de reducción de latencia frente a un concepto ampliamente establecido en la industria: la UHD. ¿Por qué este concepto todavía no se ha consolidado en la propuesta visual de los servicios televisivos de las Telco?

Se han producido dos elementos que están vinculados. Por un lado, la gente no es consciente o no exige una UHD como tal. No establece la tecnología como un criterio de calidad, sino que lo que demanda es una buena experiencia audiovisual. Por otro, hemos encontrado fórmulas para entregar una mejor experiencia con otra tecnología. Por eso, apostamos por tecnologías como el HDR, que mejora sensiblemente la calidad, así como por nuevos formatos de audio. No creo que el 4K vaya a desaparecer, pero tampoco existe un mantra que diga que todo el contenido debe ser ofrecido en estas resoluciones. A pesar de esto, el 4K irá creciendo; no sé si necesariamente en los canales lineales, pero sí bajo demanda.

"He streaming en 4K en tiempo real trae consigo problemáticas puramente técnicas que no todos los proveedores de servicios están dispuestos a abordar de forma masiva”.

No obstante, el streaming en 4K en tiempo real sí trae consigo problemáticas puramente técnicas que no todos los proveedores de servicios están dispuestos a abordar de forma masiva. Nosotros no tendríamos ningún problema en ofrecer este tipo de contenidos en 4K, pero quizá un operador que no sea de infraestructuras puede tener más dificultades al ofrecer un partido de Champions en 4K con mucha gente conectada al mismo tiempo. Aún con todo, estas cuestiones se irán resolviendo progresivamente y no serán un obstáculo para que el día de mañana el 4K sea masivo.

Redefiniendo la interacción con la televisión

Una de las próximas tendencias que definirá la UX en servicios como Orange TV y similares serán las funciones habilitadas por IA, como la utilización del lenguaje natural para interactuar con la plataforma. ¿Cuentan con una hoja de ruta para beneficiarse, a corto plazo, de estas herramientas?

Estamos utilizando la artificial intelligence en muchos ámbitos, como en nuestros motores de recomendaciones o en la mejora de la nitidez de las imágenes cuando utilizamos pósteres antiguos. También la empleamos en la agregación de contenidos, cuando a veces se solapan contenidos de diferentes proveedores y cada uno nos aporta una sinopsis diferente. En esos casos, utilizamos agentes que toman la decisión sobre qué ficha utilizar. En definitiva, la estamos usando y se utilizará cada vez más. Y habrá cosas que los clientes vean, y cosas que no vean, pero que sí noten.

En el pasado Mobile World Congress, presentamos junto con el grupo Orange un piloto de interacción con búsquedas en lenguaje natural. De tal manera, en vez de decir “Pon Matrix”, el usuario podría decir: “Quiero ver una película en la que había dos mundos y se tomaban unas pastillas”. A día de hoy, seguimos trabajando en este piloto y lo tendremos disponible en el futuro.

“Las mejoras de la experiencia no deben quedarse en un ejercicio técnico o estético, sino que tienen que seguir mejorando la experiencia de la televisión”.

Hay muchas cosas que se pueden hacer con IA, y su combinación con la voz puede ser clave. Tenemos una ventaja fundamental en ese ámbito: Infinity Home Box, nuestros decodificadores premium, cuentan con micrófonos de largo alcance. Al igual que en la actualidad se puede interactuar con ellos desde el sofá y pedir que ponga varios canales o abra determinadas aplicaciones, seguirá evolucionando para permitir muchos otros tipos de interacciones.

Con estos sistemas se abre un ámbito con muchísimas oportunidades. El reto real de la IA es que sea realmente fácil de usar, que se vuelva masiva y que aporte valor al cliente. Estas mejoras no deben quedarse en un ejercicio técnico o estético, sino que tienen que seguir mejorando la experiencia de la televisión.

En este siempre variable contexto de evolución del consumo televisión, ¿de qué manera seguirá apostando MasOrange por la mejora de su propuesta?

No creo que vaya a cambiar significativamente lo que hemos apuntado hasta ahora. El mercado seguirá creciendo de forma ligera en España, en torno al 5% anual. Es posible que se produzca alguna consolidación en el ámbito de los contenidos y los streamers, pero no debería cambiar el panorama del mercado español. En paralelo, probablemente las audiencias de los canales en abierto de la TDT seguirán cayendo.

Soy bastante positivo. Hay oportunidades para crecer. Hay líneas como la IA, the optimización de la experiencia o to content creation que tienen posibilidades de mejora. Los beneficios que obtiene el cliente al acceder a la televisión junto con los servicios de streaming a través de un operador Telco cada vez serán más relevantes. Por tanto, veo un futuro prometedor; más prometedor, si cabe, en marcas con un gran potencial.

“Hay líneas como la IA, the optimización de la experiencia o to content creation que tienen posibilidades de mejora. Los beneficios que obtiene el cliente al acceder a la televisión junto con los servicios de streaming a través de un operador Telco cada vez serán más relevantes”.

En MasOrange contamos con determinadas marcas, como MásMóvil, Pepephone, Yoigo o Jazztel que no tenían televisión hasta hace poco o nunca tuvieron un gran empuje en este terreno en comparación con marcas como Euskaltel, R o Telecable. En este punto, hay una oportunidad muy relevante para llevar toda nuestra experiencia al resto de nuestra cartera.

Es ahí donde estamos poniendo el foco. Estamos construyendo ofertas atractivas ajustadas a esas marcas que, aunque no pueden estar en los mismos niveles de precio o de propuesta de valor de Orange TV, demuestran que se pueden hacer cosas muy atractivas con una relación calidad-precio fantástica.

Una entrevista de Sergio Julián Gómez.

Did you like this article?

Subscribe to our NEWSLETTER and you won't miss anything.