Banijay take the Endemol Shine Group

La adquisición, sujeta a las condiciones de cierre habituales, abarcará las 120 marcas de producción de Endemol Shine con un estimado de 66.000 horas de programación junto con más de 4.300 formatos registrados.

El grupo Banijay ha firmado un acuerdo definitivo para adquirir el 100% del capital social de Endemol Shine Group, copropiedad de The Walt Disney Company y fondos gestionados por filiales de Apollo Global Management. La adquisición, sujeta a las condiciones de cierre habituales, abarcará las 120 marcas de producción de Endemol Shine con un estimado de 66.000 horas de programación junto con más de 4.300 formatos registrados.

Tras la adquisición, el grupo Banijay será propietario de casi 200 productoras en 23 territorios y de los derechos de cerca de 100.000 horas de contenido. Se espera que los ingresos pro-forma totales del grupo combinado sean de aproximadamente 3.000 millones de euros para el año que termina el 31 de diciembre de 2019.

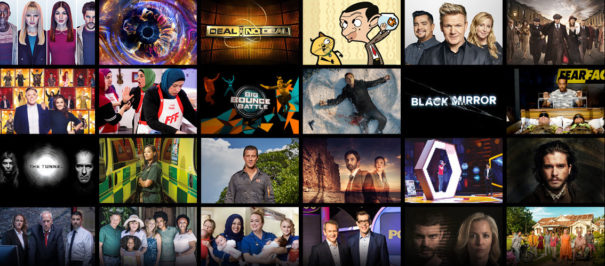

El catálogo combinado incluirá algunas de las marcas y formatos más conocidos del mundo, como Black Mirror, Versailles, The Millennium Trilogy, Peaky Blinders, Big Brother, MasterChef, Survivor, Temptation Island, Wife Swap y The Island. Además, con una cartera de marcas significativamente más amplia y una plataforma creativa más amplia, el grupo combinado estará en una posición aún más fuerte para crear, cultivar y conducir una nueva propiedad intelectual tanto para los radiodifusores lineales como para los nuevos actores.

La adquisición se financiará mediante una ampliación de capital del grupo Banijay y una financiación de deuda comprometida, que incluye una refinanciación completa de la deuda financiera existente de Banijay y Endemol Shine, apoyada por Deutsche Bank, Natixis y Société Générale. Tras el cierre, el grupo combinado estará en manos de LDH (67,1%) y Vivendi (32,9%).

LDH es una sociedad de cartera controlada por Financière LOV (52%), la rama de inversiones de Stéphane Courbit. LDH cuenta con los siguientes accionistas: el grupo italiano De Agostini, con el 36% del capital, y Fimalac, la sociedad de inversión de Marc Ladreit de Lacharrière, que poseerá el 12% del capital mediante una ampliación de capital reservada dedicada a la financiación de la adquisición de Endemol Shine. Además de una inversión directa en LDH, Fimalac reforzará su asociación a largo plazo con Financière LOV aumentando su participación en Financière LOV del 5,75% al 8,4%.

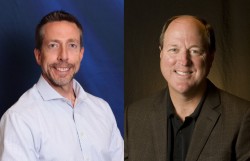

Marco Bassetti, director general de Banijay, dijha asegurado que “Endemol Shine aporta una increíble variedad de talento líder en la industria, marcas de renombre mundial y contenido creativo de alta calidad. La combinación de los recursos de estas dos empresas fortalecerá instantáneamente nuestra posición en el mercado global, y nuestras capacidades en todos los géneros nos definirán aún más como un proveedor de IP de primera clase en todo el mundo. Dar la bienvenida a las marcas y talentos de Endemol Shine a nuestro negocio actual será una señal de mejores oportunidades en el mercado, y todos estamos entusiasmados con lo que el futuro depara a la entidad combinada”.

Marco Bassetti, director general de Banijay, dijha asegurado que “Endemol Shine aporta una increíble variedad de talento líder en la industria, marcas de renombre mundial y contenido creativo de alta calidad. La combinación de los recursos de estas dos empresas fortalecerá instantáneamente nuestra posición en el mercado global, y nuestras capacidades en todos los géneros nos definirán aún más como un proveedor de IP de primera clase en todo el mundo. Dar la bienvenida a las marcas y talentos de Endemol Shine a nuestro negocio actual será una señal de mejores oportunidades en el mercado, y todos estamos entusiasmados con lo que el futuro depara a la entidad combinada”.

Por su parte, Sophie Turner Laing, directora general de Endemol Shine Group, añade que “en Endemol Shine, hemos inspirado y entretenido continuamente a audiencias de todo el mundo, un testimonio para cada una de las personas del Grupo. Este acuerdo nos lleva a un capítulo completamente nuevo y emocionante y a una nueva casa de contenido global mejorada con muchas oportunidades por delante”.

Por su parte, Sophie Turner Laing, directora general de Endemol Shine Group, añade que “en Endemol Shine, hemos inspirado y entretenido continuamente a audiencias de todo el mundo, un testimonio para cada una de las personas del Grupo. Este acuerdo nos lleva a un capítulo completamente nuevo y emocionante y a una nueva casa de contenido global mejorada con muchas oportunidades por delante”.

Did you like this article?

Subscribe to our NEWSLETTER and you won't miss anything.