The DTT shadow over pay TV in Murcia is not long

Isabel Sarabia Andúgar, professor in the Audiovisual Communication area of the Faculty of Social Sciences and Communication of the UCAM and member of the Research group (DIGITALAC) reviews pay television in the Region of Murcia in this Tribune.

Pay television constitutes a very deep-rooted mode of consumption among the citizens of the Region of Murcia. The predisposition of families to contract this service dates back to the mid-1980s, a time when cable television began to spread at the initiative of traditional operators. A decade later, in 1995, the implementation of this television access model was a reality in 34 of the 45 municipalities of the autonomous community. Since then, the presence of paid offerings, specifically cable television, has been growing.

In this context, one might ask whether the transition to digital terrestrial television in the Region of Murcia has affected the pay television market (cable, satellite, IP), and to what extent it has done so.

The data presented in this article come from the “Study of knowledge, perception and penetration of DTT in the Region of Murcia (2006-2010)”, a longitudinal investigation carried out by the DIGITALAC Group of the Catholic University of Murcia, and funded by the regional administration. As a barometer, over five editions, both the pace of DTT implementation and the way in which it has been adopted by Murcian families have been measured. In the execution of the research, a quantitative methodology has been used, based on the survey technique whose probabilistic sample (1,111 individuals) stratified by municipalities, sex and age, has been taken from the universe of elderly people residing in the Region of Murcia. of 14 years. The sampling error is +-3% and the confidence level is 95.5%.

This research began in June 2006, coinciding with the launch of the first regional digital terrestrial television signal in the Murcian Community. At that time, when DTT is at the dawn of its implementation, the pay television offer is made up of the contribution of operators from different platforms. The cable television market is occupied, on the one hand by ONO, and on the other, by the historical cable operators associated with AOTEC. Satellite television has a single operator, Digital+. And as far as IP television is concerned, on that date there is only the Imagenio offer, presented in the Region in May 2005, but others such as Jazztelia and OrangeTV soon joined it.

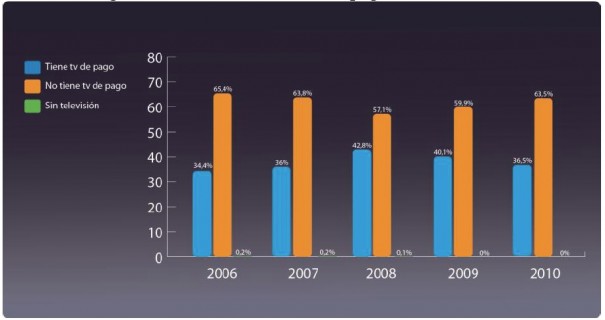

- Presence of pay television in homes in the Region of Murcia (2006-2010)

In the first wave of the study (June 2006), the level of pay television penetration is close to 35% of households in the Region of Murcia. Curiously, and despite the introduction of DTT, this percentage has been increasing over the following five years. In 2007 it only grew by one percentage point, while in 2008 the proportion of households subscribed to one of the television platforms available in the Region reached a record figure of 42.8%. In the next wave, that of 2009, the figure stood at 40.1%, and finally in 2010 once the analogue blackout was assumed, it remained at 36.5%.

Homes equipped with pay television

Source: own elaboration (Digitalac) Base: 1,111 interviews

Source: own elaboration (Digitalac) Base: 1,111 interviews

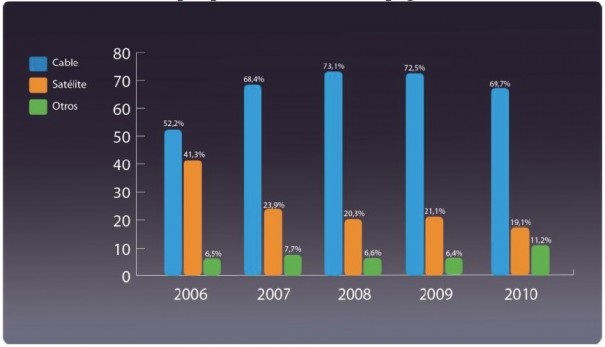

- Evolution of pay television platforms (2006-2010)

With regard to the contracted television platforms, the data show drastic changes in citizens' preferences, which affect the distribution of subscribers in the pay television market in the Region of Murcia. In 2006, of the total number of households equipped with pay television service, more than half (52.2%) had contracted the cable offer, while 41.3% had chosen the satellite platform. A year later the figures take a decisive turn. Digital + loses almost 20 percentage points that are projected over the cable option, which thus reaches 68.4% of homes that have some conditional access service.

The transfer of subscribers continues the trend, and in 2008 it is observed that 73.1% of households subscribed to some platform have opted for cable. The year 2009 passed in very similar terms – 72.5% of pay television users opted for cable, while 21.1% opted for satellite. In all these years from 2006 to 2009, IP television has not managed to penetrate homes with access to pay channels. The presence of this type of TV only became visible in 2010, when for the first time IP TV exceeded 10% of families connected to pay television. That year, the year of the analogue blackout, some alarming data was collected for the satellite television platform. The percentage of subscribers is less than 20%. Only 19.1% of families that have contracted a pay channel package had decided on Digital +. The rest, almost 70% (69.7%) had done so via cable.

Paid for by pay TV platforms

Source: own elaboration (Digitalac) Base: homes with pay TV

Source: own elaboration (Digitalac) Base: homes with pay TV

In conclusion, it should be noted that, although initially it could be suspected that, due to its multichannel offer and quality, DTT would be in a position to displace pay television, in view of the data obtained in the longitudinal study, it is confirmed that this service has not only been maintained in homes in the Region of Murcia until the analogue blackout, but has even attracted new subscribers over a period of two years. Curiously, the 2008/2009 biennium in which pay television reaches the highest levels of penetration in Murcia homes, coincides with the years in which Impulsa TDT's information campaigns are intensified and in which operators also launch promotions for its new digital channels.

One of the reasons that may explain this behavior is detected in the data related to the perception of DTT expressed by citizens, as well as the level of satisfaction it offers. Over the five years, although more than half of Murcians have shown a positive feeling towards DTT, indifference has nevertheless marked the attitude of a large group. Likewise, the degree of satisfaction has been moderate since citizens have presented reservations about the technology and the quality and interest in the channel offering.

Regarding the evolution of preferences for the pay television platform among the population of the Region, if we carefully analyze what may be the reasons for the significant increase in the contracting of cable television compared to other options , we observe that the choice is due, on the one hand, to the offer of a local television channel in the packages distributed by the historical operators (in towns in the center and north of the Region) and, on the other, to the increase in services provided, extended to landline telephony and Internet access both by Ono and by those associated with AOTEC.

In short, it can be stated that DTT has not, therefore, eclipsed pay television in the digital transition period but, on the contrary, the market for conditional access channels has even been reinforced.

Isabel Sarabia Andujar

professor in the Audiovisual Communication area of the Faculty of Social and Communication Sciences of the UCAM and member of the Research group (DIGITALAC)

Did you like this article?

Subscribe to our RSS feed and you won't miss anything.