The hundred main players in the European audiovisual sector grow twice as much as the market

He European Audiovisual Observatory publishes a new edition of its annual report on the main players in the audiovisual sector in Europe and sheds light on the structure of the audiovisual industry in terms of revenue

The report, Top players in the European audiovisual industry – ownership and concentration, has been prepared by Laura Ene, analyst at the Observatory's Market Information Department.

The analysis provides snapshots of the main players in the audiovisual sector and explores the concentration, status and origin of ownership based on revenue, pay television subscriptions, SVOD subscriptions, the number of television channels, the number of on-demand services, television audiences, the number of television fiction titles produced and the number of cinema screens. It also provides cross-sectional views for players active in more than one market segment.

This 2nd edition of the report introduces several new angles of analysis, such as the evolution of the classifications with respect to those presented in the previous edition and a new Contextualization in the context of mergers and acquisitions, case studies illustrating European presence patterns and expansion models of selected groups, as well as an analysis of the main owners of pay channels and SVOD services.

The top 100 audiovisual companies in Europe by revenue from operational audiovisual services were very resistant, dynamic and boosted the overall growth of the audiovisual market.

M&A activity has increased recently driven by telecommunications companies and this activity has been more concentrated in the Central and Eastern Europe (CEE) region.

The main players in the audiovisual sector in Europe are eclectic in terms of their main activity, which is what generates income, and in turn internationalization strategy.

On the other hand, in the market payment services, excluding the distribution of third-party services by telcos, broadcasters obtained the lion's share of subscriptions within the entire European payment services market.

Income

Los operating income from audiovisual services Accumulated earnings of the top 100 audiovisual companies in Europe grew between 2016 and 2021 twice as much as the global market and at a rate higher than average inflation. In other words, the top 100 companies will grow 17% in 2021 compared to 2016.

The positive evolution of the global audiovisual services market was due to the great SVOD revenue dynamism. Meanwhile, the cumulative revenues of the mainly traditional players (i.e. broadcasting and pay-TV distribution) among the top 100 also increased in 2021 (+10% compared to 2016) in contrast to the general evolution of the traditional market segments.

Los Traditional operators contributed 56% of revenues additional points obtained by the first 100 groups during the same period. However, the growth of the top 100 groups was largely driven by pure SVOD operators, namely Netflix, Amazon, DAZN and Apple. Their cumulative revenue grew 6x between 2016 and 2021 and accounted for 44% of the growth of the top 100 players.

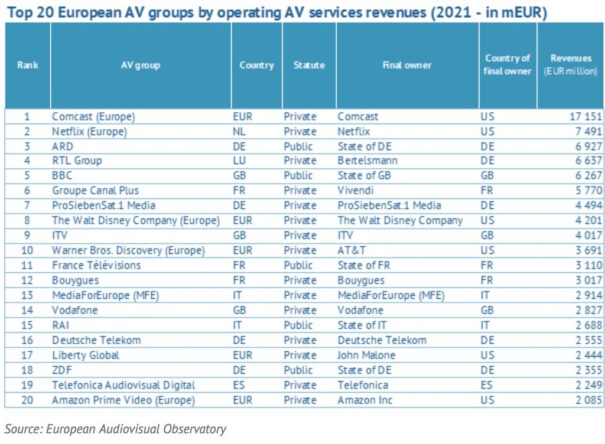

The top 20 actors consistently represented 71% of the top 100 revenue figures during the same period analyzed. Public players (RSP) showed a development below the average growth rate of the top 100 audiovisual companies and in 2021 saw their weight decrease by 3% compared to 2016 and, consequently, their market share fell to 30% in 2021.

He weight of American interests in top 100 companies' revenue increased in 2021 (+3% over 2016, to 30% market share by the end of 2021) mainly due to the rise of pure SVOD operators, but also of SVOD services from US-backed broadcasters such as Sky, Paramount+ and Disney+. US operators tend to prioritize expansion through direct investments by launching video-on-demand platforms, acquiring European assets and producing local content, over traditional indirect investments.

Mercado SVOD

SVOD stands out as the most concentrated segment of the audiovisual market in Europe, followed by pay television. At the end of 2021, a total of 71% of SVOD subscriptions were accrued by subscribers to the top 3 OTT platforms (i.e. Netflix, Amazon and Disney+), while 76% of pay TV subscriptions were accrued by the top 20 pay TV operators.

The subscriptions to paid audiovisual services (pay television and video on demand) accumulated in 2021 by the main operators of paid audiovisual services that own at least one prominent pay television channel or a video on demand platform show an interesting fact. Indeed, it can be deduced that the interests of European-owned groups respond to a very different profile from those of American-owned groups in Europe.

Broadcasters of prominent pay television channels represented more than 80% of the European subscription quota accumulated to paid audiovisual services. Unlike pure video-on-demand operators in general, supported broadcasters in Europe tend to also be active in the pay-TV segment, from which they derive an average of half of their cumulative subscriptions to audiovisual pay services.

On the contrary, the Pure SVOD platforms are driving 70% of US subscription share to pay-per-view services, while the rest of the subscriptions are accumulated by the large American networks and European networks supported by the United States.

Did you like this article?

Subscribe to our NEWSLETTER and you won't miss anything.